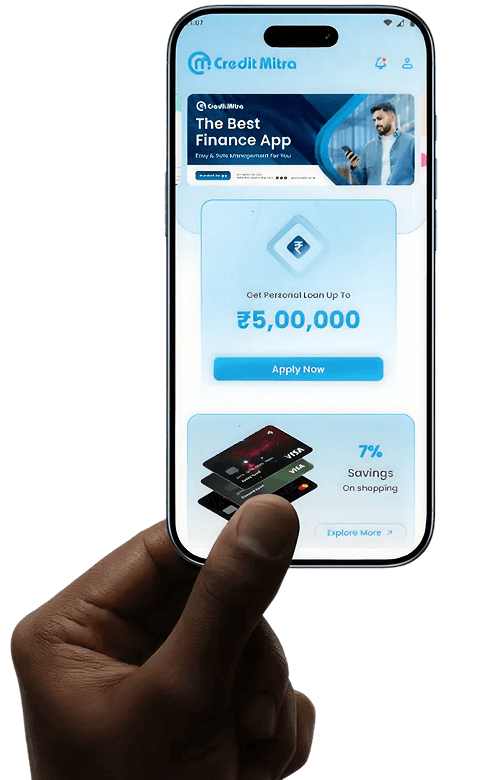

Check Your Credit Score

for FREE in 2 Minutes

Get personalised loan offers based on your CIBIL score for free. Monitor your credit health and improve your financial profile.

Check Your Credit Score for FREE in 2 Minutes

Get personalised loan offers based on your CIBIL score for free.

What is Credit Score?

A Credit Score is a three-digit number that ranges from 300 to 900, indicating your ability to repay debts. A higher credit score reflects a stronger repayment capacity, whereas a lower score suggests the opposite. When applying for a personal loan, your credit score is a crucial factor. Having a good score is necessary for obtaining a loan and can lead to more favourable terms and lower interest rates.

Understanding CIBIL Score

A credit score is an important indicator of your financial health and creditworthiness. It typically ranges from 300 to 900. The credit score is affected by factors such as repayment history, credit mix, new credit inquiries, and credit utilisation ratio. If you maintain a credit score of 750 or above, you will have a better chance of getting approved and receiving a better loan offer at CreditMitra.

A healthy credit score not only helps you access credit easily but also assures you of lower interest rates, higher credit limits, and greater financial flexibility. When you check your CreditMitra score regularly, you are informed and empowered to take control of your financial life.

Benefits of a Good Credit Score

How Does CIBIL Score Work?

A credit score below 650 is considered a bad score. If your score is below 650, you're likely to be rejected for a loan or credit card.

Your credit score may not be sufficient to qualify for a loan, and you should work to improve it continuously since it's not considered a very bad credit score, but it's still seen as a risk factor.

It is considered good to have a score between 700 and 749. However, these scores are not adequate to get decent mortgage approvals.

An excellent credit score is between 750 and 900, which indicates that you have made all your repayments on time and that you are a low-risk borrower, which allows you to qualify for the best interest rate.

Benefits of good credit score

Benefits of good credit score

The benefits of having a good credit score are numerous. The following are a few of the most important:

With a good credit score, you are more likely to be approved for loans and credit cards at lower interest rates. You will also benefit from lower interest rates, which can save you a lot of money over the long run.

You may qualify for a lower insurance rate if you have a good credit score. The reason for this is that they are considered lower risks.

A good credit score may allow you to qualify for a mortgage with a lower down payment. It can save you a lot of money up front.

Tips to Improve Credit Score

Setting Reminders to Avoid Late Payments

Your outstanding debts have a significant impact on your credit score. To avoid any delays in making repayments, you must maintain discipline. Setting reminders is a good way to keep yourself updated about upcoming loan EMIs. In addition to impacting your credit score, delays will also result in penalties.

Keep Old Credit Cards to Maintain a Lengthy Credit History

It is important to keep all your old credit cards if you have been using them to pay your bills on time. This will help strengthen your credit score in the future.

Go for a Longer Loan Tenure

Longer loan duration leads to lower EMIs and vice versa. You will be able to improve your credit score with low EMIs, thus enhancing your chances of getting a loan without any problems.

Do Not Take on Excessive Debt at Once

You are more likely to miss repayments if you take too many loans at once. It is better to take one loan and repay it within a fixed period of time to avoid defaults. It depicts an unending cycle of loans and an insufficient amount of funds if you take multiple loans of the same type at once. A healthy credit mix is always good, but taking one loan at a time will make it easier for you to repay your debts on time and increase your credit score.

Review Your Credit Report and Rectify Errors

It is also possible that the credit rating agency filed incorrect information when updating your credit record. This includes incorrect information and delays in recording. These factors can adversely affect your credit score. Thus, it is a good idea to periodically check your credit report. On the official website of the agency, you can submit an online dispute to dispute any errors on your credit report. Ensuring that your credit report is error-free will increase your chances of getting a high credit score.

Frequently Asked Questions