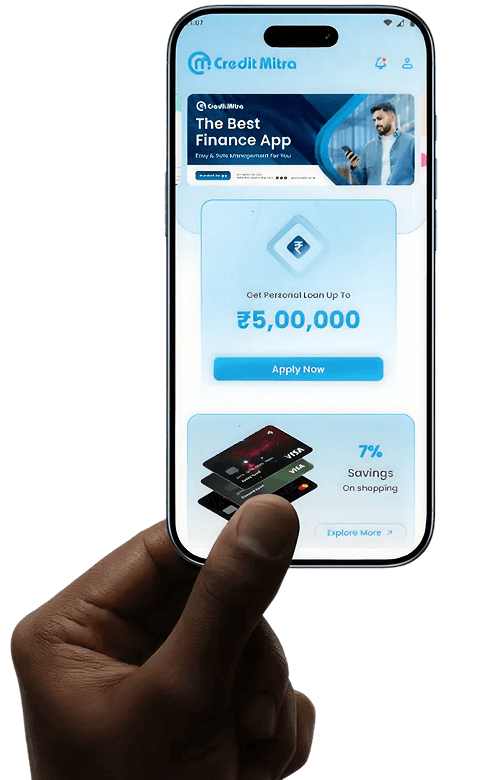

India's Best Mutual Fund Investment Platform | CreditMitra

Open your mutual fund account online with CreditMitra. Enjoy 0% brokerage on direct mutual fund purchases. Easy, paperless & secure investing. Invest now!

Why Choose CreditMitra?

Experience the future of mutual fund investing with our secure, transparent, and user-friendly platform.

Safe & Secure

SEBI Registered Distributor with bank-grade encryption

Expert Recommendations

Handpicked funds curated by financial experts

Quick Onboarding

100% paperless process, start investing in minutes

Portfolio Tracking

Real-time insights and performance analytics

Choose Your Investment Style

Diversify your portfolio with our carefully curated mutual fund categories

Equity Funds

High growth potential with market-linked returns

Debt Funds

Stable returns with lower risk profile

Hybrid Funds

Balanced approach with equity and debt mix

ELSS Funds

Tax-saving funds with 3-year lock-in

About CreditMitra Mutual Fund

About CreditMitra Mutual Fund

CreditMitra Mutual Fund offers a wide array of investment options - from low-cost index funds to ELSS funds, among other investment options - across sectors, market caps and geographies to meet investors' unique financial objectives. CreditMitra Mutual Fund launched six index funds in 2022 to cater for investors' different risk profiles. Low-cost funds, a passive investing approach, and strong leadership make CreditMitra Mutual Fund one of the most popular AMCs in the country.

How To Choose a Mutual Fund?

Financial Goal

Invest in a mutual fund that aligns with your financial goals. You may opt for a combination of equity and debt funds for your long-term financial goals, whereas debt funds could be a good fit for your short-term goals. If you want to maximise your tax deductions, you can invest in ELSS.

Cost

A mutual fund comes with certain costs, such as expense ratio, exit load, tax on capital gains, etc., which add to the gains (if applicable). Since active funds are actively managed by fund managers, they have a higher expense ratio within SEBI’s limit. When making investment decisions, keep the investment costs in mind.

Risk Appetite

Investing in equity funds involves market risks in the short term, which can make them risky, while debt funds could be relatively low-risk. Choose a fund that fits your risk tolerance.

Past Performance

To understand how a fund has performed in the past, check its past performance. While past performance does not guarantee future returns, it can still provide insight into a fund’s potential.

Start Investing in 3 Simple Steps

Begin your wealth creation journey with CreditMitra

Complete KYC

Aadhaar and PAN verification for quick digital KYC

Choose Funds

Choose from 500+ mutual funds based on your goals and risk tolerance

Start SIP

You can start systematic investing with just ₹500 per month

Mutual Fund Calculator

Investment Type

Our top Investors

Frequently Asked Questions